In the world of finance, knowing your customer is more than just good business practice. It's a crucial part of regulatory compliance.

This process, known as Know Your Customer or KYC, is vital in preventing financial crimes. It helps institutions ensure they're not inadvertently aiding money laundering or other illicit activities.

But it isn't just about compliance. It's also about protecting both financial institutions and their customers. A robust process can help build trust, enhance customer experience, and even provide a competitive edge.

However, traditional KYC processes can be time-consuming and prone to errors. That's where digital technologies come in. New tools, from automation to artificial intelligence, are revolutionizing Know Your Customer procedures.

In this article, we'll explore the importance of KYC, explore its evolution, and examine how businesses can leverage technology to streamline their processes. Whether you're a financial institution, a fintech startup, or simply interested in financial regulations, this guide is for you.

What is KYC and Why Does it Matter?

Know Your Customer, or KYC is a process used by financial institutions to verify the identity of their clients.

KYC involves collecting and verifying a customer's identity, address, and occupation information. This process is a regulatory requirement and a crucial part of risk management. It is typically conducted when a new customer is onboarded.

The importance extends beyond compliance. It helps institutions better understand their customers, enabling them to provide more personalized services. Moreover, a robust process can enhance customer trust and loyalty.

Here are some key reasons why KYC matters:

- Compliance with Anti-Money Laundering (AML) regulations

- Prevention of identity theft and fraud

- Protection of the institution's reputation

- Enhanced customer experience through personalized services

- Risk management and mitigation

The Key Components of KYC

The required information collected from customers will vary from sector to sector and even bank to bank. However, Section 326 of the Patriot Act sets forth minimum compliance requirements that include:

(a) verifying the identity of any person seeking to open an account to the extent reasonable and practicable;

(b) maintaining records of the information used to verify a person's identity, including name, address, and other identifying information; and

(c) consulting lists of known or suspected terrorists or terrorist organizations provided to the financial institution by any government agency to determine whether a person seeking to open an account appears on any such list.

Based on the minimum requirements and each institution's risk appetite, financial institutions prepare a Customer Identification Program (CIP). At a minimum, every business falling under the Patriot Act must have a CIP containing:

- A written program

- Four pieces of identifying information (often called the 'core four') - a customer's name, date of birth, address, and identification number.

- Identity verification procedures

- Record keeping

- Comparison with government lists (ensuring the customer doesn't appear on any OFAC or other government sanction lists).

- Customer notice (the financial institution must let its customers know it's requesting information to verify their identities).

Digital KYC processes are part of the firms' CIP requirements. They verify the customer's identity.

The Role of KYC in Financial Compliance

KYC plays a pivotal role in financial compliance. It's a key component of Anti-Money Laundering (AML) and Counter-Terrorist Financing (CTF) regulations worldwide.

Non-compliance with these regulations can result in hefty fines and penalties. More importantly, it can damage an institution's reputation, causing it to lose business and customer trust.

Protecting Against Financial Crimes

Institutions can detect and prevent illicit activities by verifying customer identities and monitoring transactions.

This includes money laundering, terrorist financing, and fraud. By doing so, KYC protects the institution and contributes to global efforts to combat financial crime.

The Evolution of KYC: From Manual to Digital

The KYC process has evolved significantly over the years. Traditionally, it was a manual process involving physical documents and face-to-face interactions. This method was not only time-consuming but also prone to errors and inconsistencies.

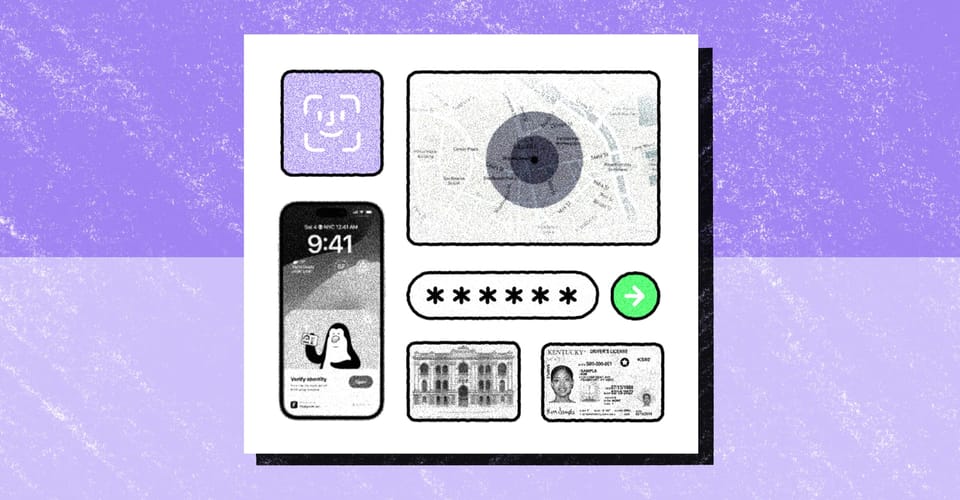

We now know your customer automation. You can verify customer identities digitally using data verification, ID document scans, and biometric data. This shift has made the process faster, more accurate, and more efficient.

This method is known as electronic Know Your Customer or e-KYC. It reduces the risk of errors and fraud and improves the customer experience. It also allows for continuous monitoring of customer transactions, enhancing the institution's ability to detect and prevent illicit activities.

However, implementing e-KYC requires investment in technology and infrastructure. Despite these challenges, the benefits of e-KYC are undeniable.

How Automated KYC Verification Enhances Efficiency

Automated KYC verification is a game-changer for financial institutions. It uses technology to streamline the process, making it faster and more efficient.

Automation eliminates the need for manual data entry, which is time-consuming and prone to errors. It also allows for real-time verification, reducing the time it takes to onboard a customer.

Rather than manually verifying a driver's license, KYC software collects and verifies information from your customers in real time.

Speed and Accuracy in Customer Onboarding

One key benefit of automated KYC verification is that it speeds up the customer onboarding process. With traditional methods, onboarding could take days or even weeks. With automation, it can be done in minutes.

Automated KYC verification also improves the process's accuracy. It eliminates the risk of human error, which can lead to costly mistakes. It allows for real-time verification, ensuring the customer's information is accurate and up-to-date.

However, speed and accuracy should not come at the expense of security. Ensuring that the automated KYC process is secure and compliant with regulatory requirements is essential.

Reducing Operational Costs and Risks

Automated KYC verification can significantly reduce operational costs. It eliminates the need for manual data entry, which is time-consuming and costly. It also reduces the need for physical storage of documents, which can be a significant expense.

In addition to cost savings, automated KYC verification also reduces operational risks. It reduces the risk of human error, which can lead to costly mistakes and regulatory penalties. Moreover, it enhances the institution's ability to detect and prevent illicit activities, reducing financial crime risk.

However, implementing automated KYC verification requires investment in technology and infrastructure. These costs must be considered when evaluating the benefits of automation.

KYC Best Practices for Businesses

Implementing a robust KYC process is crucial for businesses, especially those in the financial sector. It helps prevent financial crimes and ensures compliance with regulatory requirements. However, implementing KYC has its challenges.

Selecting the Right KYC Tools and Service Providers

One key challenge is selecting the right KYC tools and service providers. There are many options available in the market, each with its own strengths and weaknesses. It's important to choose a solution that fits your business's specific needs and capabilities. This article provides a good guide on some of the more popular KYC onboarding software and their pros and cons.

When selecting KYC tools, consider factors such as ease of use, integration with existing systems, scalability, and cost.

Remember, the goal is to comply with regulatory requirements and improve operational efficiency and customer experience. Therefore, choose tools and providers that can help you achieve these objectives.

Ensuring Data Privacy and Security

Data privacy and security are crucial in the KYC process. The information collected during the process is sensitive and should be protected from unauthorized access. Failure to do so can lead to data breaches, resulting in financial losses and company reputation damage.

Some KYC software, like Footprint, offer built-in vaulting solutions to vault all sensitive data automatically. They also let you assign identity access management to control who from your team has access to which data.

Conclusion

Understanding the importance of KYC is crucial for any business operating in the financial sector. It helps compile with regulatory requirements, protects against financial crimes, and enhances customer trust.

As KYC processes evolve, businesses must stay abreast of the latest trends and technologies to ensure efficient and effective compliance. The future of KYC promises exciting developments, with the potential to transform customer onboarding and risk management.