The fraud landscape is evolving faster than ever. The emergence of generative AI tools like deepfake generators and fraud-specific large language models (LLMs) has opened up new frontiers for bad actors. In fact, fraud losses tied to AI-enabled scams and synthetic identities are surging — with some estimates placing total losses for 2024 near $50 billion.

At Footprint, we recently hosted a webinar, Optimizing Your Onboarding in the World of GenAI Fraud, where we dove into the challenges businesses face and the strategies they can adopt to stay ahead of fraudsters. Here’s a teaser of what we covered:

The GenAI Fraud Playbook

The power of GenAI tools means fraudsters no longer need sophisticated skills to launch highly effective attacks. They can generate fake identity documents that mimic real ones, create convincing videos in response to prompts, or use LLMs to draft realistic phishing emails. The result? More fraud, more often, at an unprecedented scale.

In our webinar, we shared examples of fake IDs that fooled top-tier identity verification systems over half the time. These aren't just isolated incidents; fraud is becoming easier to scale with minimal cost. The question isn't just how to detect it — it's how to make fraud unprofitable and unattractive.

Why Fighting Fraud with AI Alone Isn’t Enough

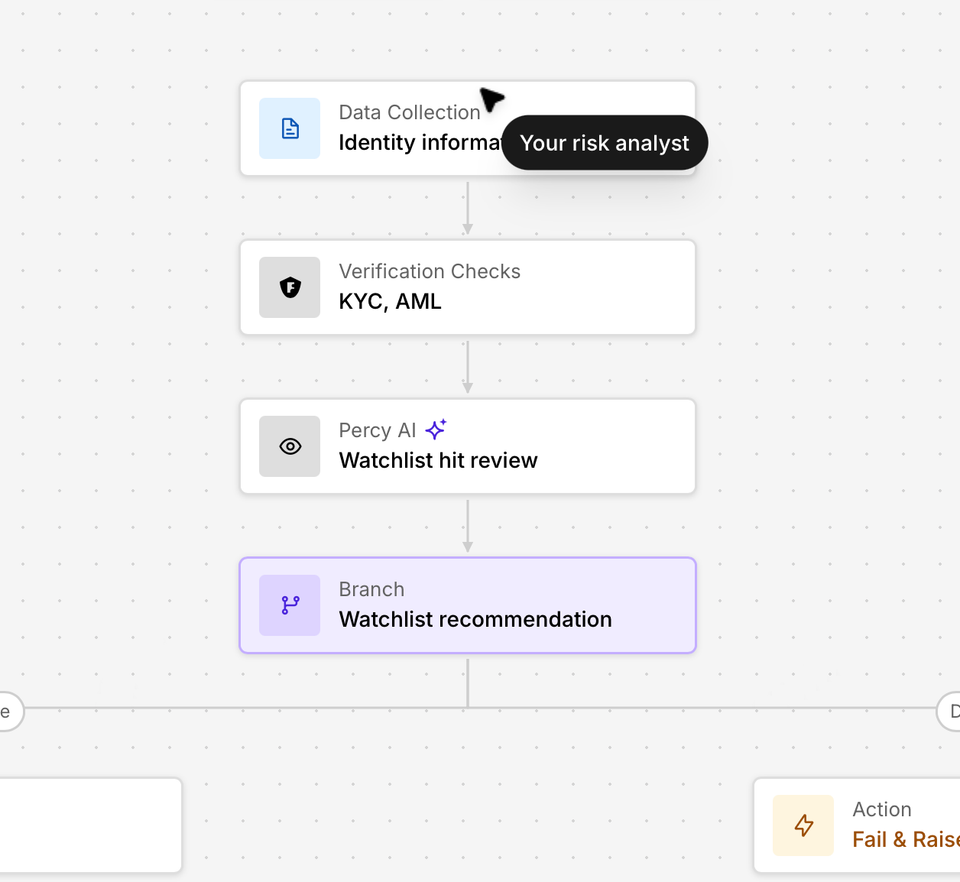

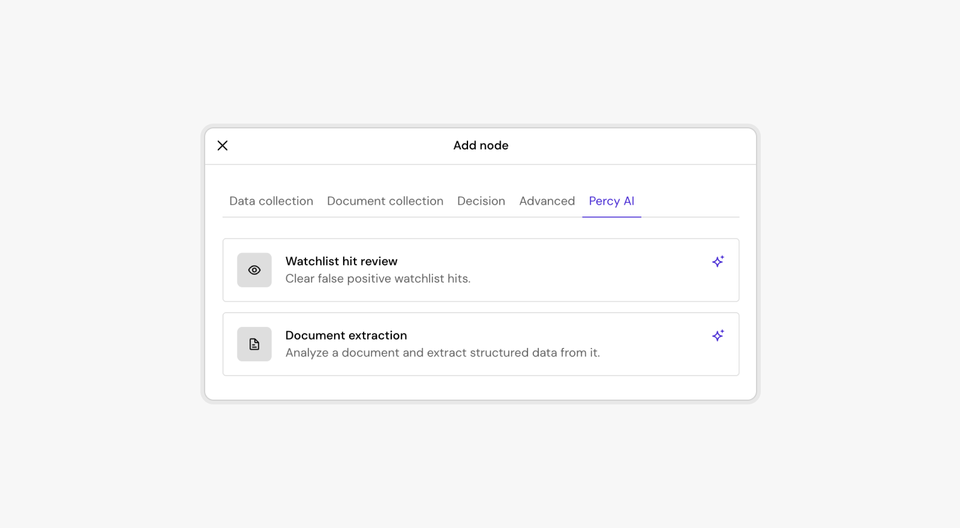

While AI-driven tools are indispensable for combating AI-generated fraud, they’re not a silver bullet. Fraudsters evolve quickly, and any system relying solely on visual or behavioral AI is at risk of falling behind. We discussed why a multi-layered approach is crucial for addressing this new wave of fraud.

A few key takeaways:

- AI vs. AI: AI tools can help detect synthetic identities and deepfakes, but they’re only as good as their training. Emerging AI detection systems often lack explainability, making it harder for humans to backtest or validate their results.

- Behavioral signals and passive tools: Leveraging behavioral and passive signals like device integrity, network analysis, and timing can create a holistic picture of a user, helping to detect anomalies without overwhelming friction for legitimate customers.

- Progressive onboarding: Instead of front-loading all verification steps, consider spreading them out. Progressive onboarding increases fraudster costs and gathers more information over time, while reducing churn for legitimate users.

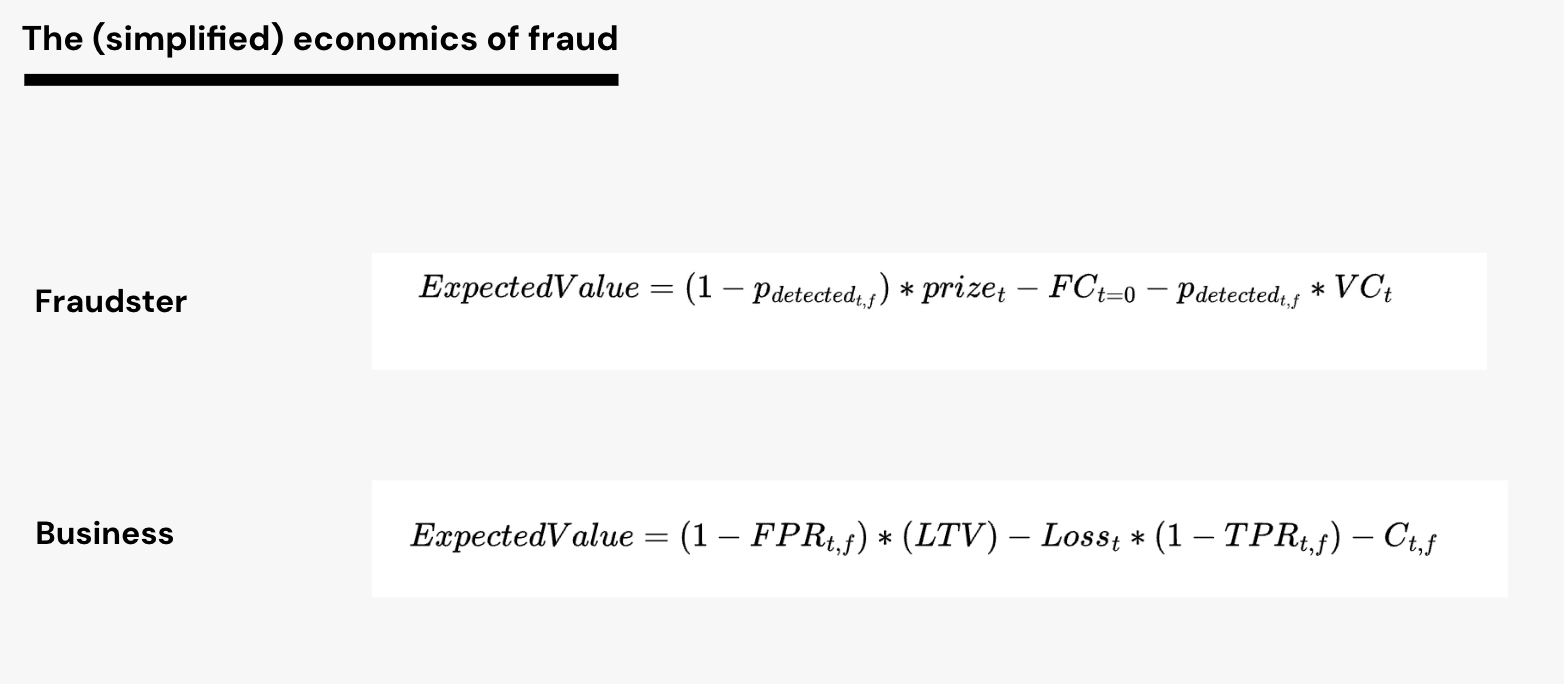

The Economics of Fraud

Fraud prevention is as much about economics as it is about technology. In our webinar, we walked through a framework to think about fraudsters' incentives and how businesses can respond:

- Reduce the prize: Just like Stripe reduced payouts for micro-deposit fraud to make the scam unappealing, you can rethink risk-adjusted transaction limits.

- Increase costs: Simple interventions like 2FA or device binding can deter casual fraudsters. More sophisticated checks — such as step-up verifications — can raise the cost for even the most determined fraudster.

- Target the gray area: No system is 100% certain. That’s why having a strategy for ambiguous cases — like requesting more documents or data — is essential.

The Path Forward: No Single Solution

The reality is that no single tool, whether AI or otherwise, will stop all fraud. But a multi-layered approach that combines cutting-edge technology, human oversight, and thoughtful strategy can give you the upper hand.

From adjusting verification flows to dissuade fraudsters, to empowering manual reviewers with data, to leveraging tools like Footprint’s platform for comprehensive fraud prevention, the fight against GenAI-enabled fraud is about staying adaptive and proactive.

Want to learn more? Watch the full recording of our webinar and get actionable tips for protecting your business while optimizing onboarding for legitimate users.

👉 Watch the Webinar Recording Here

Fraud may be inevitable, but with the right approach, it doesn’t have to derail your growth. Let’s outthink fraudsters together.