At Footprint, we’re not very good at keeping secrets — or rather new features — under wraps. If you’ve talked to anyone on our team, you probably have heard the amazing strides we’re taking to fight onboarding fraud as core pillar of the Footprint platform. Today we’re excited to publicly launch all these features, which together comprise a new core capability of the platform: Footprint Fraud.

Footprint Fraud is not just a single new fraud-fighting feature, but rather a collection of tools that work together seamlessly to power your product (and team) to fight fraud on a large scale and quickly and iteratively enable new defenses as new attacks arise. These tools extend not only to “at time of onboarding” but also to your manual review process, and even more so an ability to learn from your fraud experiences to automate future escalations. In this post we’ll talk through the main capabilities that make Footprint Fraud a really new special part of our platform.

Onboarding controls

At Footprint, we don’t like to provide you tools without giving you fine-grained ability to dial up protections in a certain population. These new fraud-focused updates to our onboarding controls allow you to require attest-able user experiences to ensure live document capture, collect additional forms of identification, and perform enhanced device checks to further bind the human behind a computer to the information being presented at onboarding time. All done with a simple Playbook or rules configuration. Onboarding controls let you enforce:

- Ensure live capture of document and selfie by requiring AppClip/InstantApp (even when a user starts on a Desktop).

- Seamlessly handoff to a mobile device for web onboarding to check the user’s (native) mobile device for performing the IDV step in order to attest a non-jailbroken/rooted device that has a clean fingerprint.

- Silently confirm the user’s phone number actually matches the SIM card installed in their device

- Collect additional identity document, confirming that the face in the captured selfie matches both documents, and both documents match the core identity profile of the user.

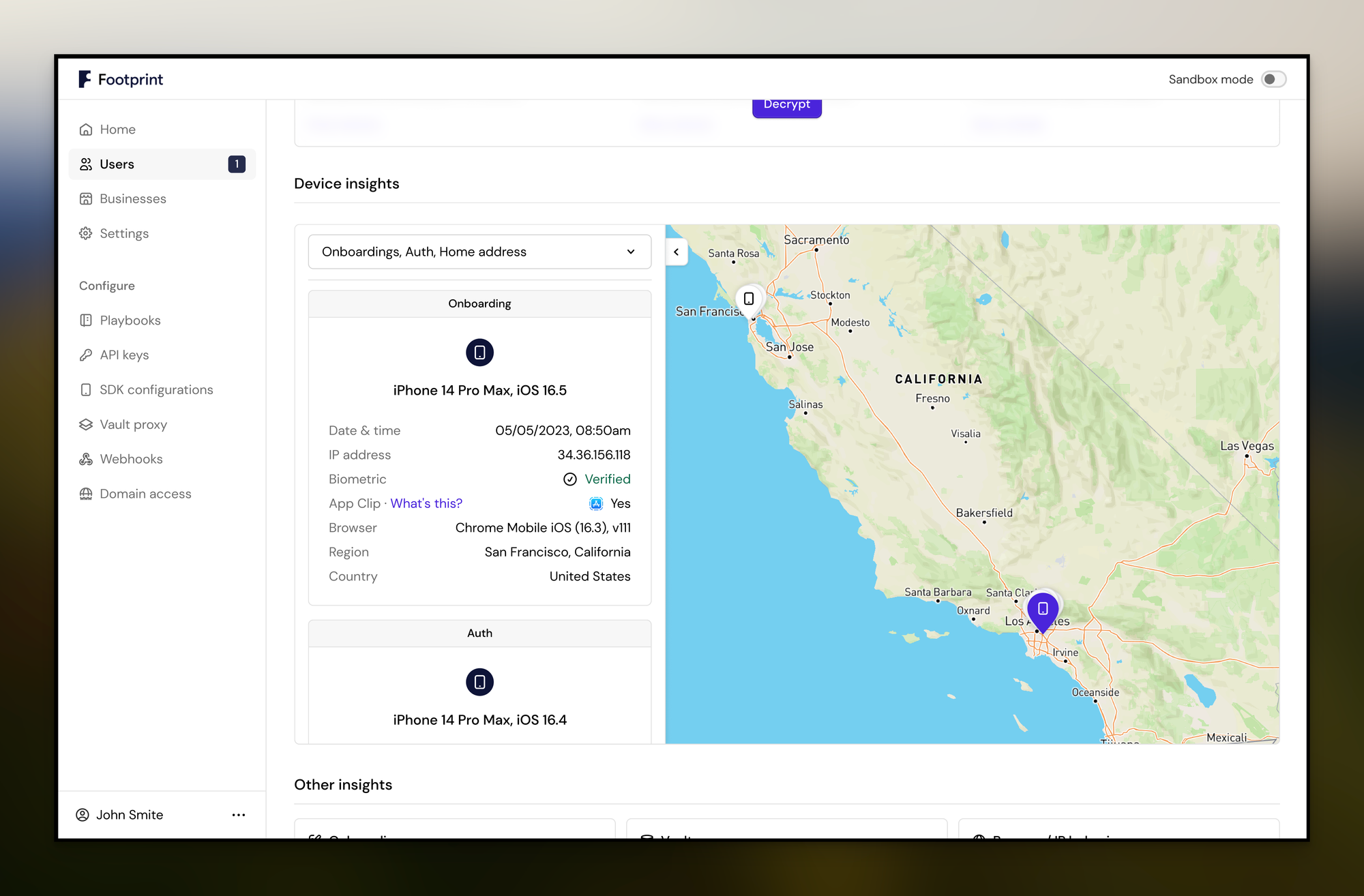

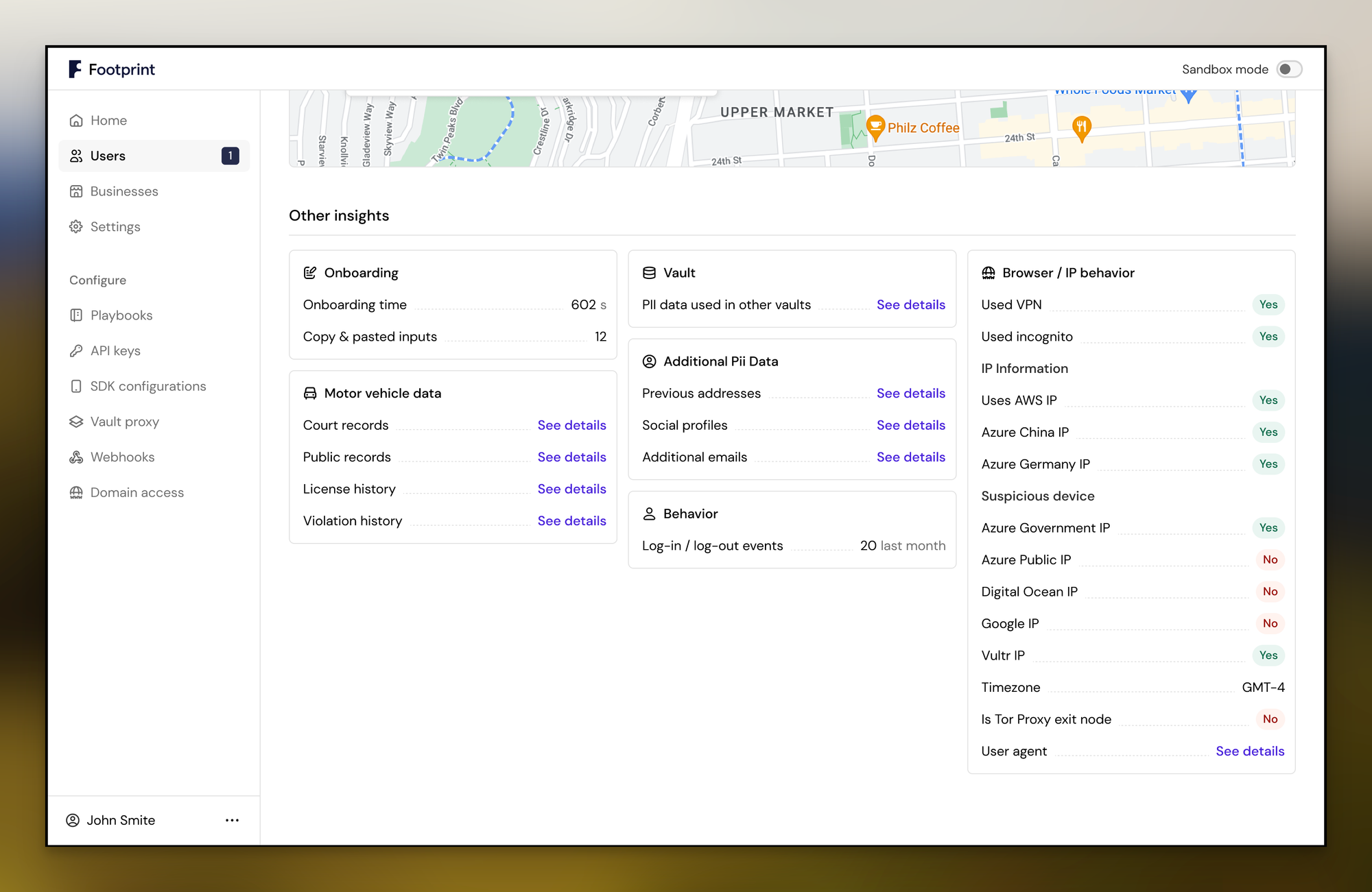

User Behavior and Device Insights

Automate suspicious behavioral analysis that runs while the user completes their onboarding form. Detect anomalous behavior such as typing hesitancy, copy-paste for fields like SSN/DOB, devices on bad reputation networks, fraud-ring detection, and more. With new behavioral fraud detection, Footprint enables you to automate step-ups (like collecting an attested document) based on suspicious user actions. Maximize conversion for good users while minimizing cost and fraud from bad actors.

All new user behavioral insights, device insights, and user interactions (like authentication events) are now visible and searchable to aide the manual review process and give more color to the Risk Signals returned. See what device a user used, for what, when, and from where.

Additional verifications

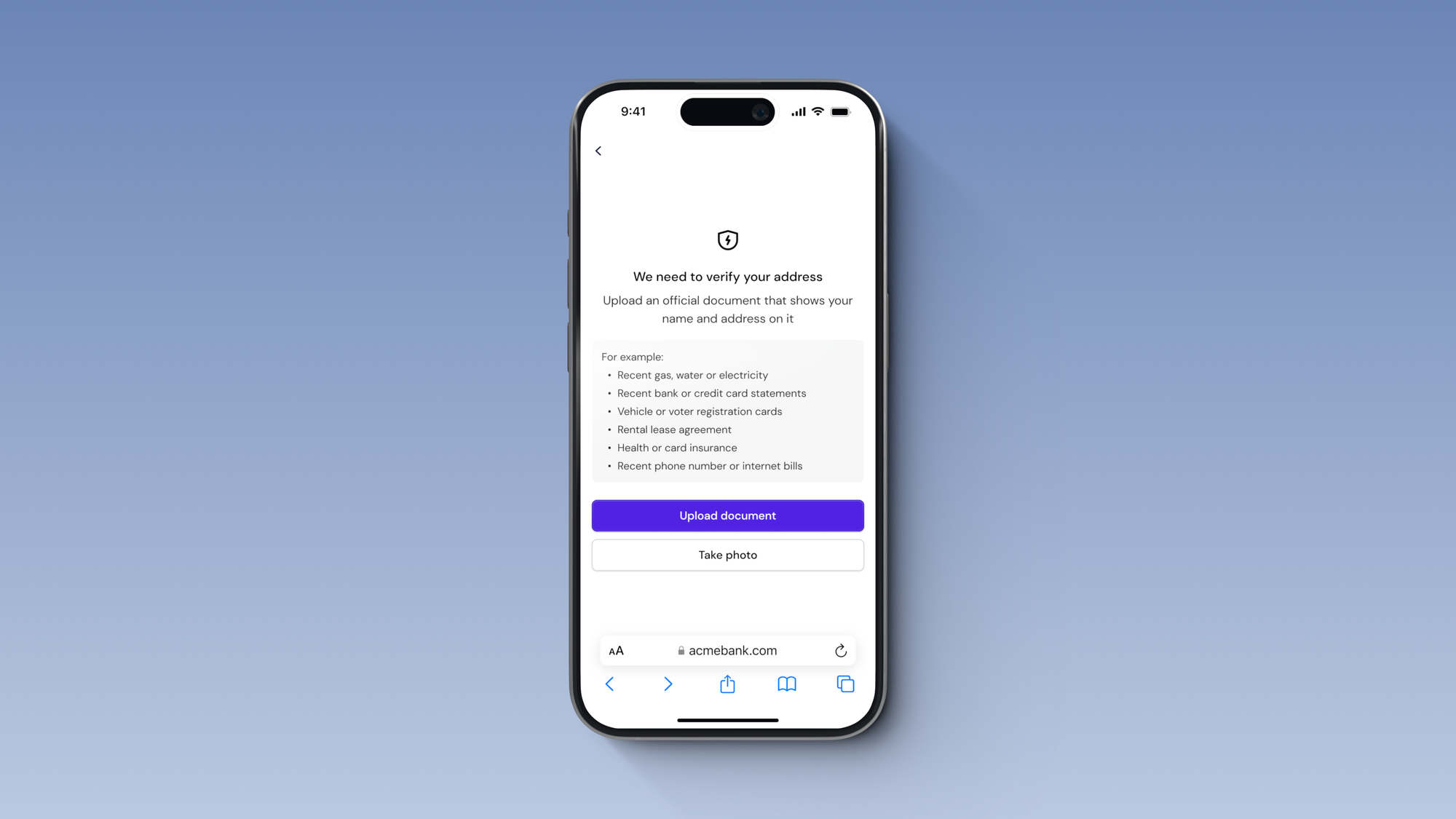

With this update, Footprint is also launching the ability to verify and collect new kinds of documents and data.

- Enhanced Drivers License validation and motor vehicle history: verify the data on the document with the registered information from the respective DMV database to prevent document fraud. Fetch reports on the user’s vehicle history during review to enhance decisions.

- Document collection and verification: automate collecting documents like utility bills, bank statements, and W2s and automatically detect tampering and abuse. Extract structured document data for further review and analysis.

- Mexico and Canada Non-documentary verifications: Verify user CURP/INE data (Mexico) and SIN (Canada) for additional enhanced non-documentary verifications.

As always, these verification can be declared as requirements for every user or just as step-ups for higher-risk users.

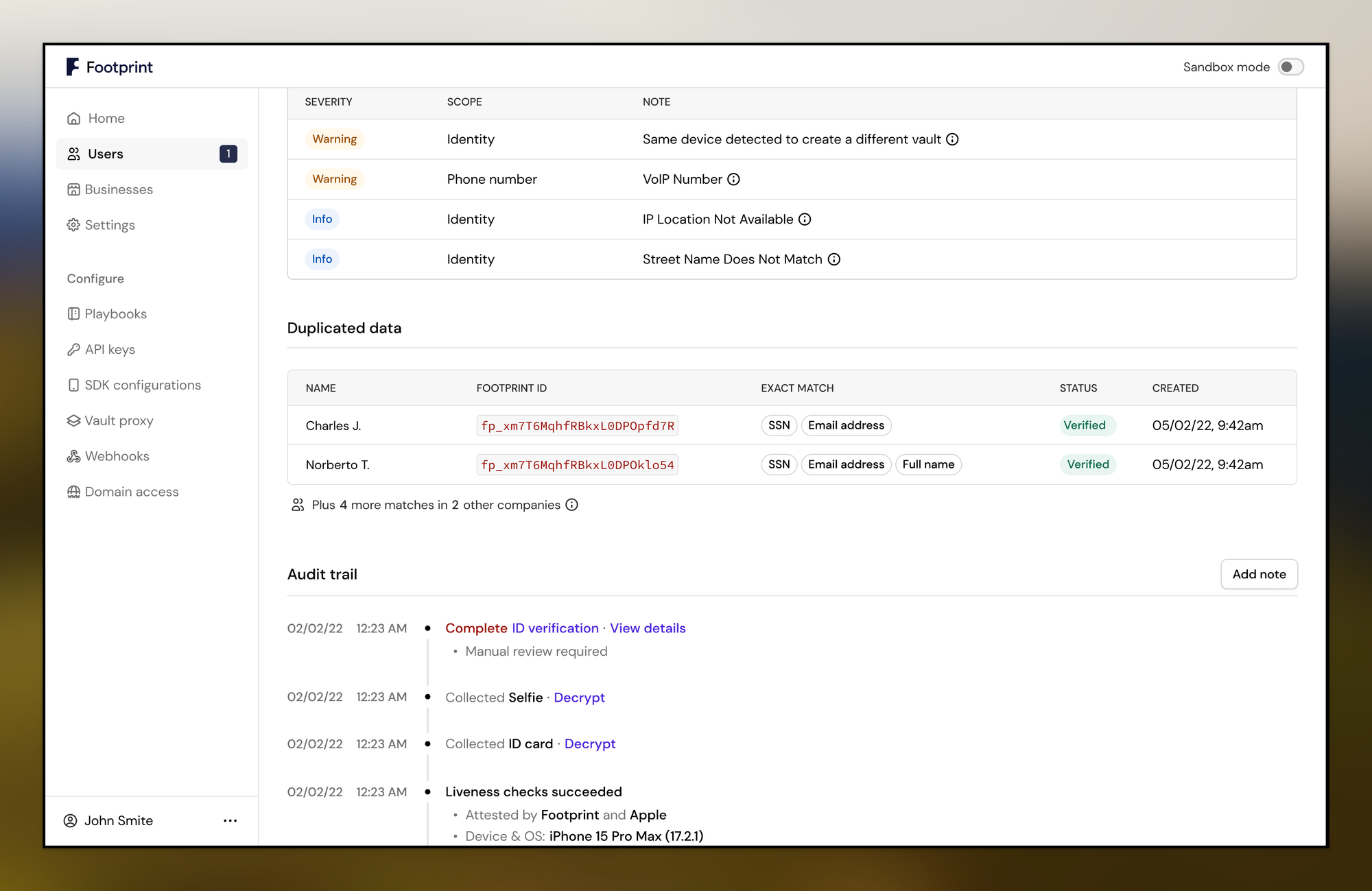

Duplicate & Synthetic fraud

Footprint’s unique duplicate fraud detection analyzes many dimensions of an identity to let you catch the same person signing up for your product with multiple (potentially stolen) identities.

- Enhanced screening for synthetic data using new providers.

- Selfie duplicate detection: detection whether or not the user signing up has been seen before on your product (or anywhere in the Footprint ecosystem) with a different identity.

- Identity data de-duplication: secure analysis of overlapping identity data (i.e name, date-of-birth, ssn) and device and browser usage to detect duplicate fraud.

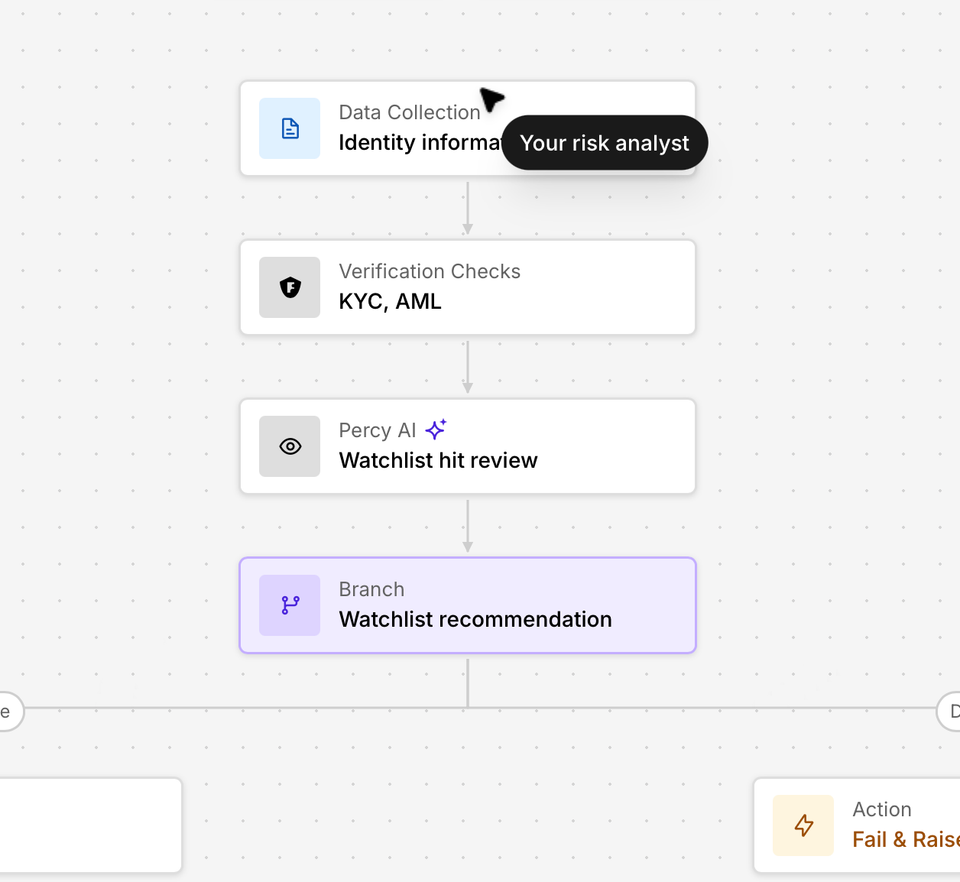

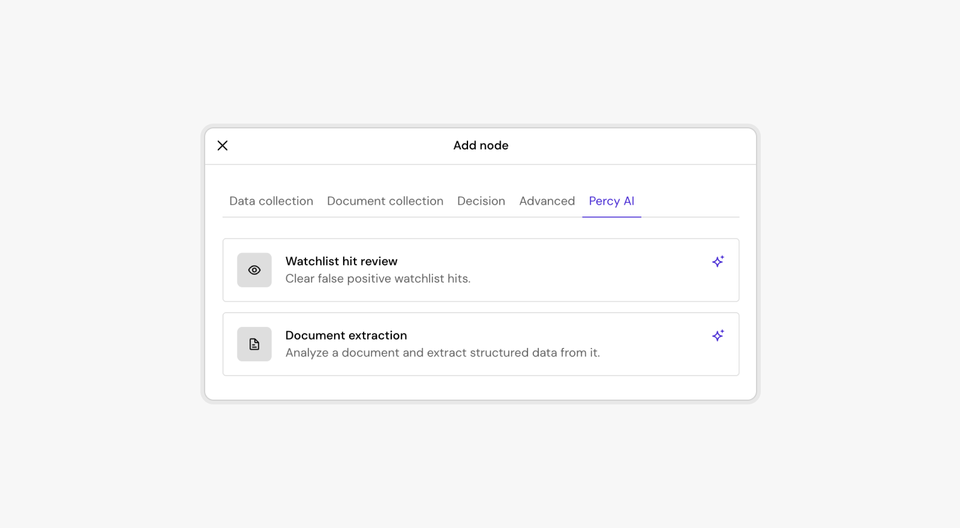

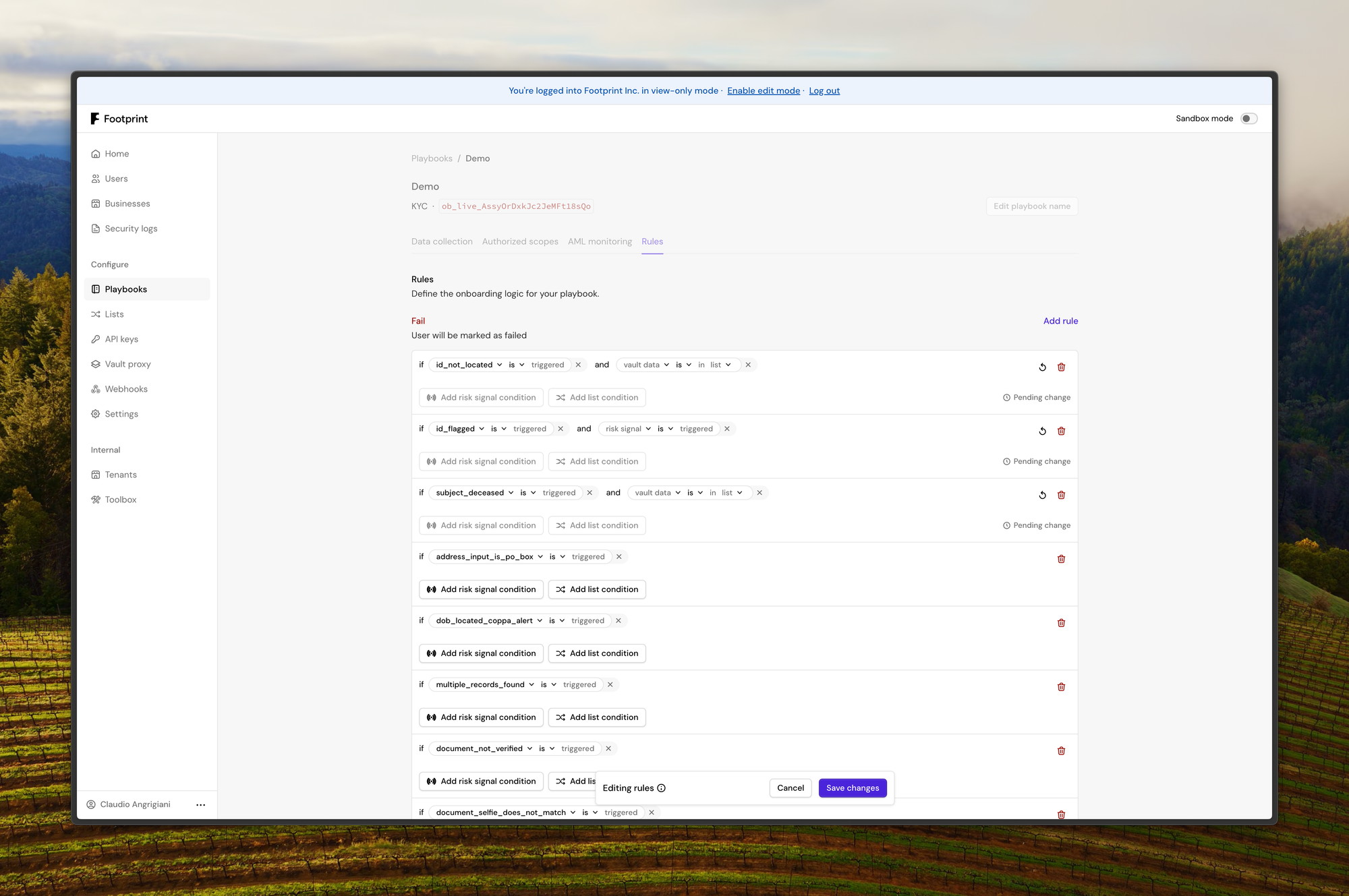

Enhanced Rules & Review

Every new fraud tool exposes new Risk signals, User and Device Insights in Footprint that enable you to proactively act on fraud risk as it appears in your product: send certain risky users to manual review or trigger step-ups to collect more data and make better decisions — all with no code!

Additionally, Footprint is launching a new Manual Review interface to put these new capabilities at your fingertips for each new review case. Just to name a few new improvements:

- Improved document review UI.

- Get summarized, human-readable review results with AI.

- New and improved risk signals view to explain in detail why certain decisions were reached.

- Historical KYC and user data: see how user’s onboard and re-onboard, to get a full picture of their data as it may change.

- Review queues: configure different review types and assign different team members to manage different types of risk by creating review queues.

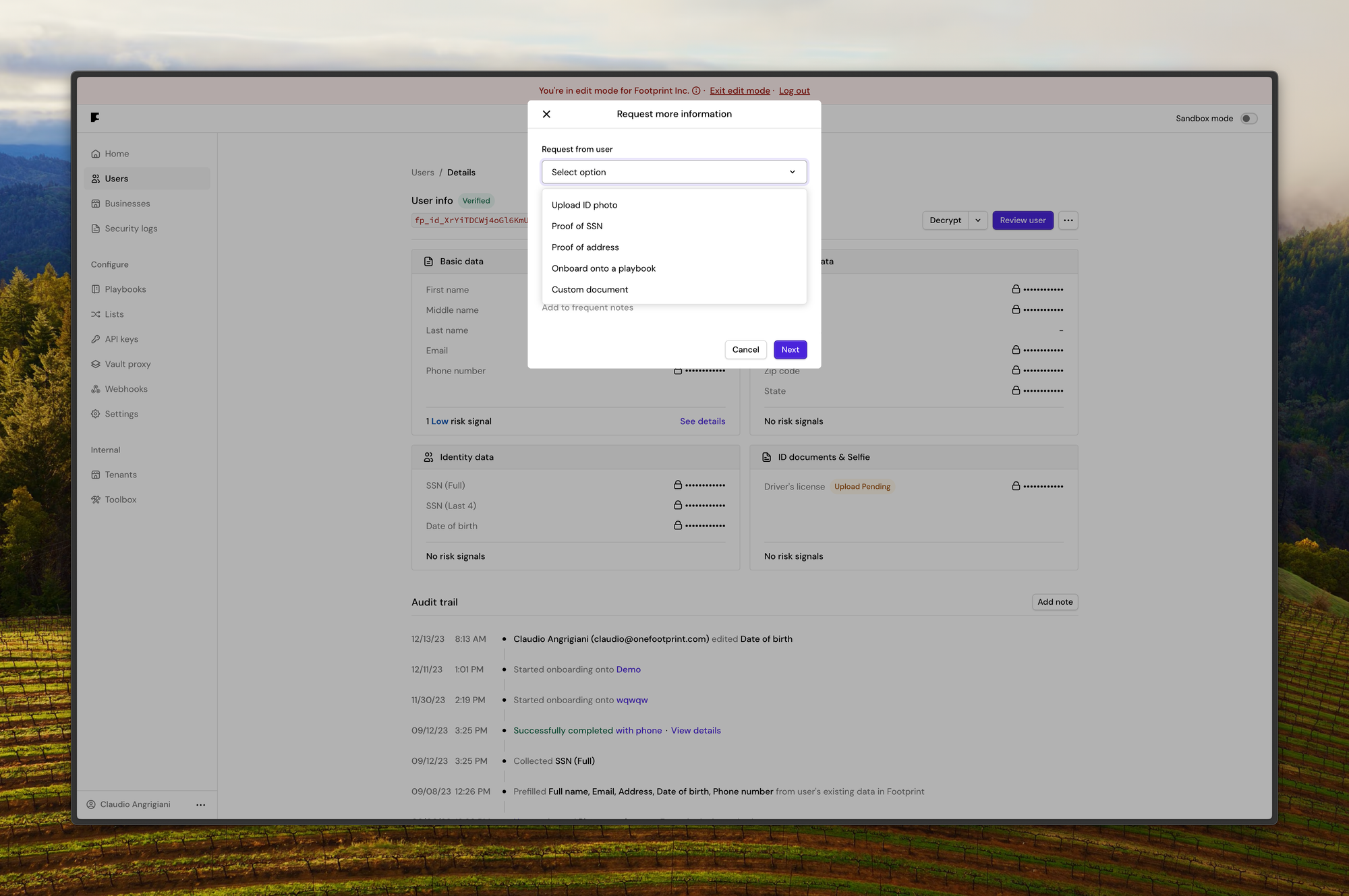

- Request more actions from a user, like a bank statement, additional identity documentation or perform additional fraud and data enrichments all from the Footprint dashboard.

- Label and tag users based on your own criteria or mark when a user has been off-boarded for fraud. Use this data in your rules engine to make better automated decisions.

What’s next?

This is just a quick summary of the new fraud tools coming to a Footprint dashboard near you. Stay tuned for more updates!