Before the Civil War, over 1600 banks in the US were allowed to circulate currency, each with the name of a bank on it and the value in dollars that the bank promised to pay in coins if the note was presented to them. Eventually, some eight to nine thousand different-looking state bank notes reached the population. All of them had their own design, and as you would expect, it was an absolute disaster. There were financial banking crises in 1837, 1839–1842, and 1857, causing banks to suspend the convertibility of their banknotes. Checks were likewise not standardized, leading to only further mayhem.

This system was inefficient and made it easy for counterfeiting to occur, as there were so many different types of notes in circulation and it was difficult to distinguish real ones from fake ones. It was also costly to return a note from a bank in one location to the issuing bank in another location, so these notes circulated at discounted rates depending on how far they were from the issuing bank.

Having competing versions of banknotes in circulation made it challenging for people to determine the value of each note. Different banks issued notes with unique denominations, designs, and colors, making it onerous for individuals to determine the value of a particular note. This lack of sameness caused confusion and mistrust among the general public, as people were unsure about the value of the money they were using.

It also became an arduous process for banks to determine the value of each other's notes and checks. As a result, a process known as "reciprocity" emerged, where banks would only accept the notes and checks of other banks if those banks agreed to accept their own notes and checks in return. This created a complex web of agreements and obligations between banks, which made it difficult for people to use the notes and checks of different banks.

Due to this litany of problems, the job of the government to effectively regulate the financial system became near impossible. Without a uniform currency, it was difficult for the government to track the movements of money and ensure that banks were operating responsibly. This made it easier for banks to engage in risky or fraudulent practices, further undermining the stability of the financial system.

While parts of our financial system have learned lessons from the 19th century, sadly others have not. KYC today is sadly a similar tale as bank notes and checks in the 1800s in America. It faces the same issues stemming from a lack of a standardized system in place. Today in the United States, there is currently no standard set of KYC requirements that all banks must follow, which means that each bank is free to develop its own KYC processes.

Similar to when we had thousands of banknotes in circulation, this can lead to confusion and mistrust among the general public, as people may not be sure what types of information they need to provide to different banks or financial institutions. The result is bad news for banks and FIs: confusion makes it difficult for people to open bank accounts or engage in other financial transactions, as they may not be sure what documents they need to provide or how they need to be presented.

This problem also makes it more difficult for banks to determine the risk profile of their clients. If each bank is using its own set of KYC requirements, it can be challenging for banks to compare the risk profiles of different clients or to determine the risk posed by a particular client. This can make it more difficult for banks to manage their risk and may lead to an increased risk of financial crimes, such as money laundering or financing terrorism. Above all, banks and fintechs can’t leverage the approval of peers, because each has its novel set of rules.

We see this problem play out time and time again when we speak to companies and people. Companies lament that they need to re-do KYC each time someone onboards and configure their rules accordingly. There are some companies out there that have different internal teams who have different KYC requirements. Leading KYC companies only encourage this, by pushing byzantine labyrinths of unlimited customization to each customer. We find this to be utter mayhem: why should two fintechs serving a similar clientele and facing the same regulations have different KYC rules? Why should they not be able to leverage each other’s KYC results? Why is KYC today using 9,000 different bank notes?

There needs to be a defined bar for people to clear, and once cleared, find it easier to create accounts. This will build trust in the public in our digital financial ecosystem, allow for companies to onboard more users, and decrease fraud as we standardize our systems.

The parallels between banking in the 19th century and KYC today are both sad and amusing. Counterfeiting was rampant when there was such a plethora of notes out there that it was difficult to distinguish which was real. Today, synthetic identities infect our system with fraud because we have no universal database of real identities. Banks had fractional banking; fintechs today have the incapacity to upsell their own products without having to introduce friction. The mistrust in the public caused by the many shapes, colors, and designs of banknotes mirrors the 50% abandonment rates reported across FIs as consumers are faced with different sign-up flows each time they encounter a new product.

It is remarkable that we were able to solve the problem of lack of standardization in checks and money notes 150 years ago, yet we haven’t been able to solve this same exact problem with KYC. We see the same problems: people are confused and interact less, there is an inability for interoperability with lost time due to repeated processes, and there is an increase in fraud with no central authority. This has resulted in more fraud and a tougher job for regulators to help us make the system better. But we don’t need to guess about moonshot ideas to make this better. The roadmap is pretty similar, and has been spelled out for us for 150 years. We need to standardize KYC.

This speaks to an idea we have written about previously, where a standardized system lets us move away from verifying the bad actors to the good actors. Do we want to go back to a system when we have to figure out which of 8000 bank notes are real, or stay in one where we can verify that seven are legitimate?

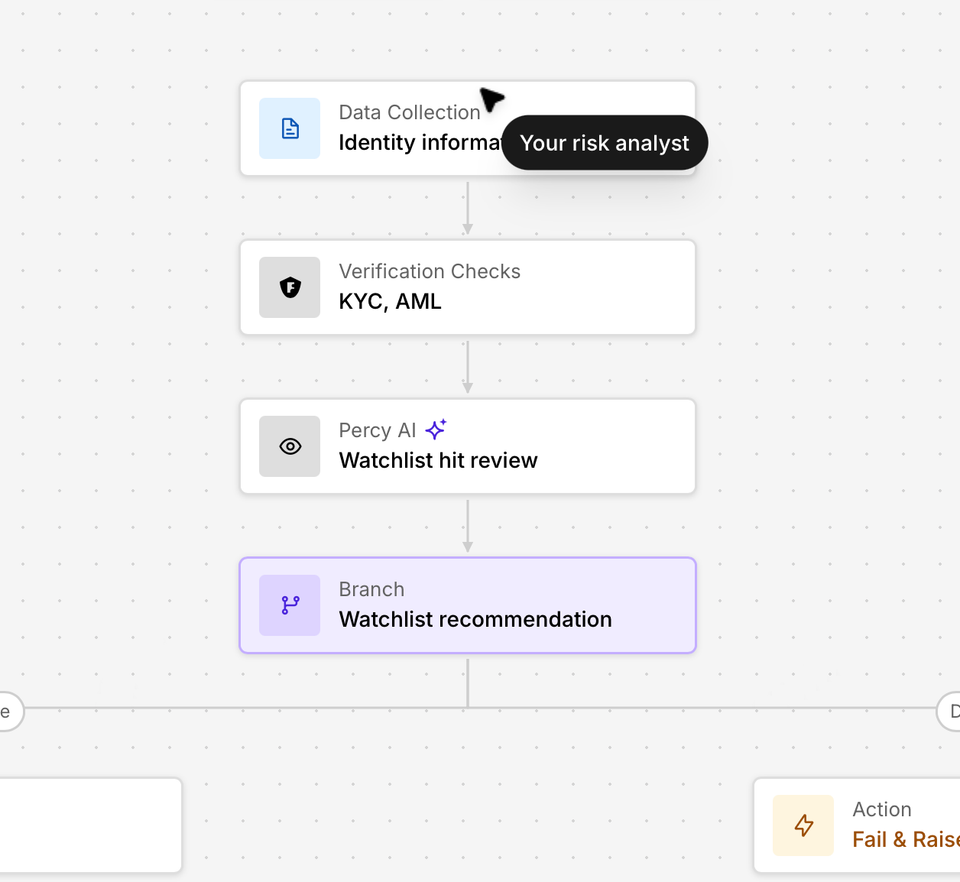

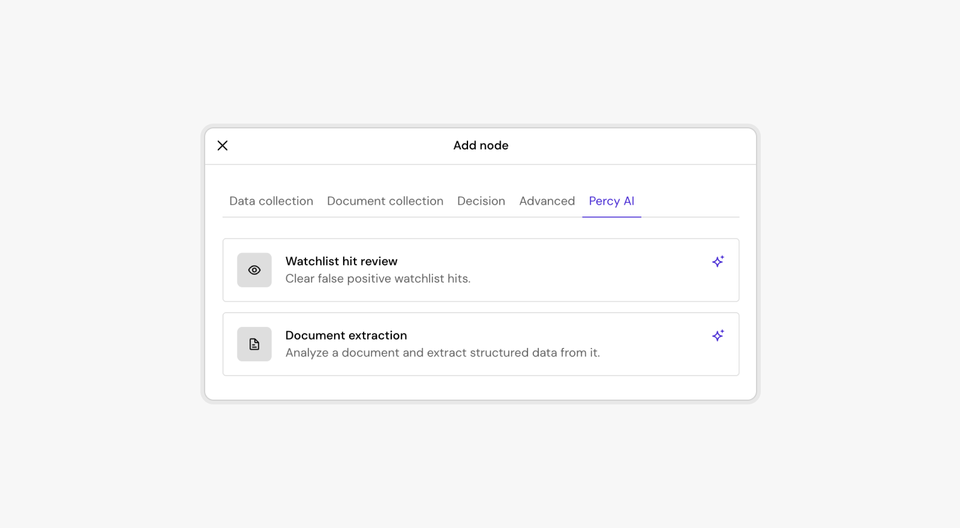

Standardized KYC practices would help to promote stability and trust in the financial system. Our goal is to modernize KYC. We’ll take a first step of bringing it out of the 19th century. Footprint has been built to do just that.