The fintech industry is in constant competition to deliver seamless onboarding experiences, but with the rush to make processes fast and user-friendly, security is often challenged. Fraud risks are always present, and with financial products, striking the right balance between speed and security is critical. At Footprint, we’ve developed a guide that shows fintech companies how to boost their onboarding conversions without compromising on fraud prevention.

In our guide, 5 Tips to Boost Your Onboarding Conversion Without Being Defrauded, we dive into practical, actionable strategies to streamline onboarding while keeping bad actors out. Here’s a glimpse of the key points:

Key Tips for Converting and Protecting Users:

- Master CIP Compliance: Understanding and aligning with your banking partner’s Customer Identification Program (CIP) reduces onboarding friction while ensuring you meet essential compliance standards. Tailoring your onboarding process to different CIP requirements can streamline the flow and prevent avoidable user drop-offs.

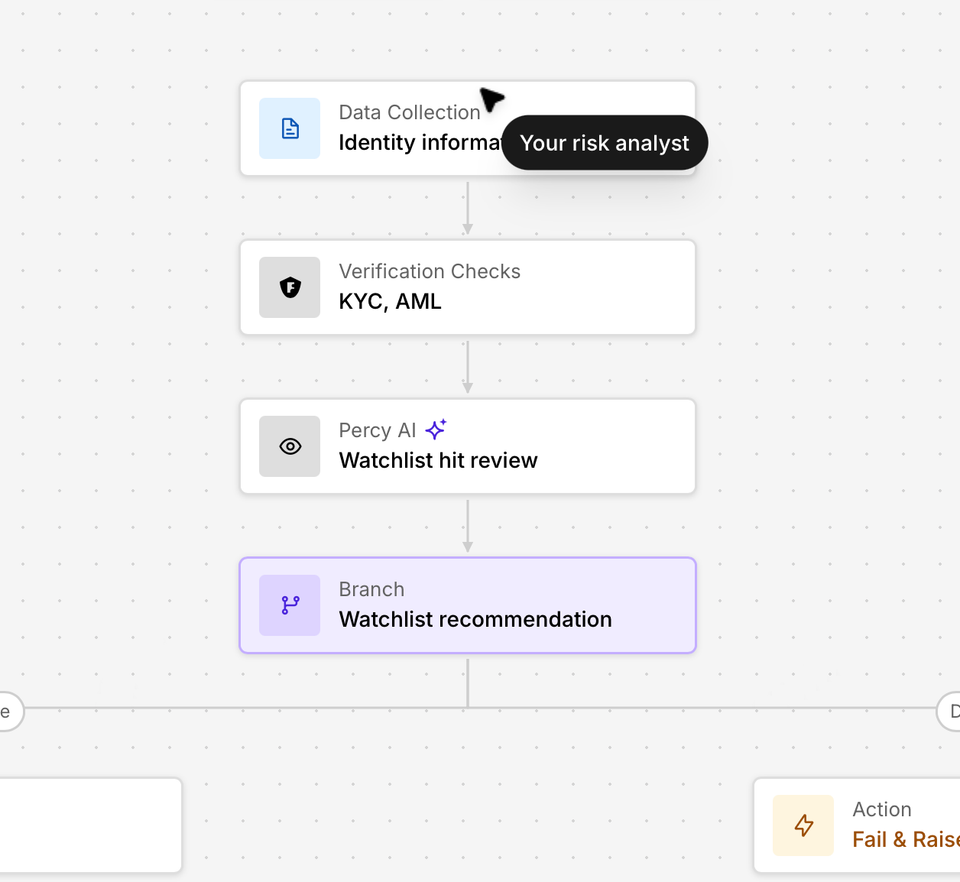

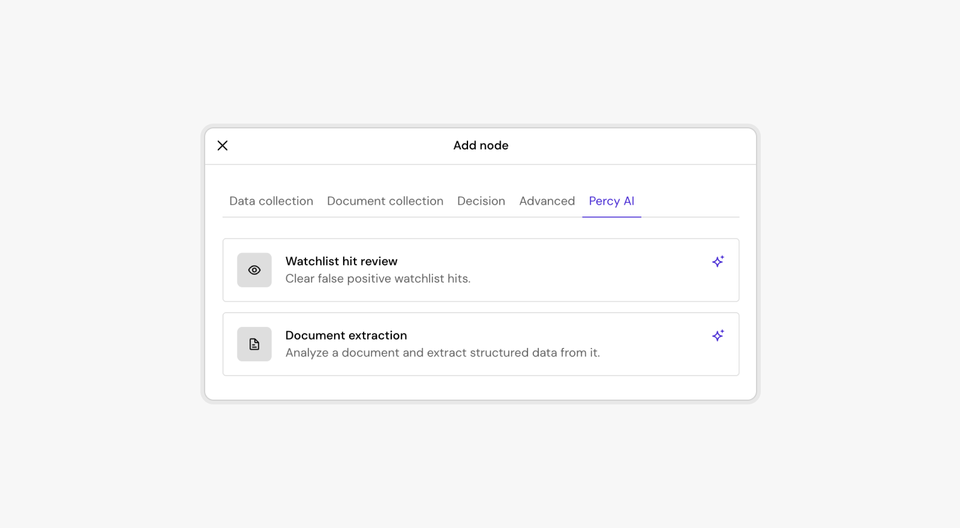

- Leverage a Dynamic Rules Engine: With fraudsters constantly adapting, a static fraud detection model can lead to false positives and bottlenecks. A dynamic rules engine that adapts to real-time risk signals helps keep legitimate users moving through the onboarding process while applying additional verification steps to high-risk users.

- Build Trust from the Start: Clear language, visible security measures, and social proof establish confidence in your platform from the first interaction. Users who feel their data is secure are more likely to complete the onboarding process.

- Use Modular Flows: Avoid overwhelming new users by gathering information in phases. Modular onboarding reduces fatigue, improves conversion rates, and lets you adjust the flow based on each user’s risk profile.

- Choose the Right KYC Partner: The right KYC solution does more than tick a compliance box; it should support fraud detection and enhance the user experience. A customizable, secure, and real-time KYC process minimizes friction and boosts user trust.

Why Footprint?

Footprint’s platform enables fintechs to strike the right balance between conversion and security with features like dynamic behavioral analysis, device fingerprinting, and modular onboarding components. With Footprint, you can reduce fraud risk while ensuring a seamless experience for genuine users.

👉 Download our guide today to explore all five tips in depth and transform your onboarding process into a conversion-driving asset that keeps fraud at bay.