We are thrilled to announce the release of Footprint's new KYB (Know Your Business) solution, which is designed to work seamlessly with our existing integrated KYC (Know Your Customer) and PII (Personally Identifiable Information) vaulting capabilities.

With this product release, Footprint is leveling up — we’re not just a product that does KYC — we help you onboard all of your customers. Our goal is to be the onboarding platform for fintechs. To us, this is not possible if we view identity narrowly on just a KYC level, as our identities power so many other identities. And with this thought, we know good KYB must be linked to the people behind the businesses.

When we speak to customers, they often complain about the same people coming back under the guise of new companies to commit fraud. They’ve keyed in on something important: it is not that businesses necessarily commit fraud, but rather the people (or beneficial owners) behind them do. This is why simply validating that a business is real is no longer enough to prevent fraud; companies must know the people behind the business to gain the trust of who they are onboarding to their platform.

This is why we’ve built Footprint’s KYB capabilities not as a separate product, but as an extension that sits atop our leading identity verification and vaulting technology. We send links to each beneficial owner of a company to tie their device and passkey to their identity. This means that if a business commits fraud, it will be linked to the beneficial owners if they were to start a new company (a process that’s fairly easy these days). Our customers would be able to view the note on their identity that the BOs were associated with fraud in the past.

At the same time, Footprint KYB keeps the same goal as our KYC: reward good actors for using the internet. We do this by removing the default view that everyone is bad by using a variation of our architecture to make businesses portable. What this means for beneficial owners is that Footprint now can also be the last KYB form you ever fill out. If you were to KYB on a bank that uses Footprint, and then get a corporate card on a Footprint-supported platform, it would be as easy as one-click.

Our KYB solution provides a comprehensive suite of tools that enables businesses to gain a better understanding of their customers' businesses and mitigate the risks associated with fraud, money laundering, and other financial crimes. We are partnering with Middesk (and utilizing bureau data) to help power our product.

At Footprint, we understand the importance of having reliable and secure data and access management systems in place. That's why our KYC and PII vaulting capabilities ensure that your customer data is kept safe and compliant with regulatory requirements at all times. Our KYB solution builds on this foundation, giving you a complete picture of your customers' businesses and the associated risks.

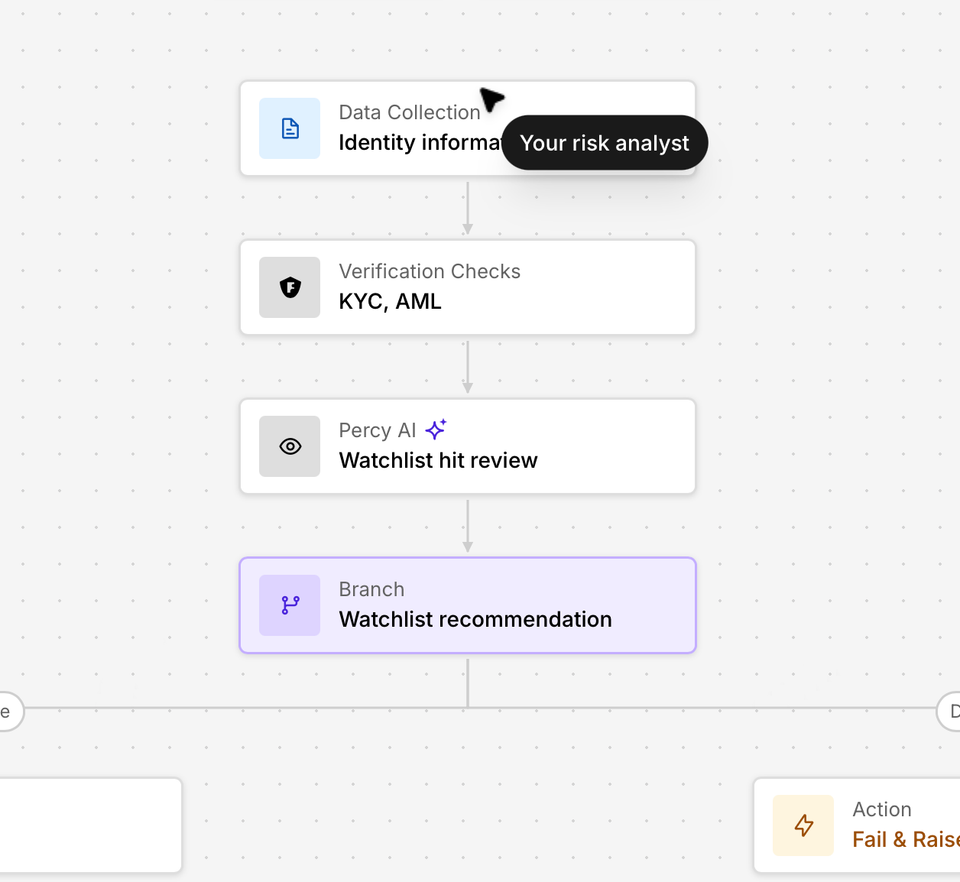

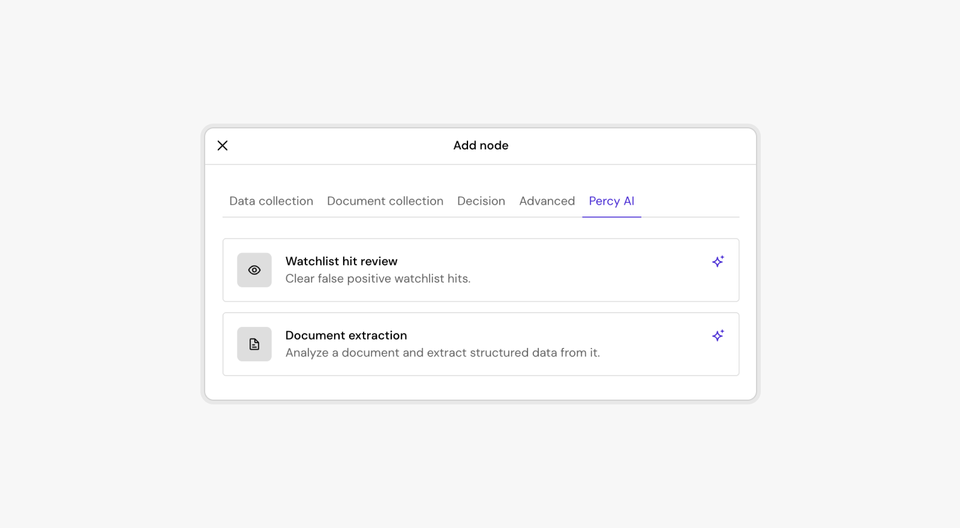

With Footprint's KYB, you can easily verify the identity of business owners, directors, and authorized signatories, as well as perform due diligence on suppliers, partners, and other third parties. Our solution also allows you to monitor changes in your customers' risk profiles, track beneficial ownership, and screen against sanctions and watchlists.

One of the key benefits of choosing Footprint as your provider for KYB, KYC, and PII vaulting is the seamless integration between these solutions. It’s a single API, a single SDK, and can be integrated in just a few lines of code. By having all of these capabilities in one place, you can streamline your compliance processes, reduce operational costs, and improve your overall risk management. Our platform is natively customizable and can be tailored to meet the specific needs of your business. We understand that every organization is unique and may require a different approach to compliance. Our goal is the Footprint platform.

Contact us today to learn more about how Footprint's KYB, KYC, and PII vaulting solutions can help your business stay compliant and secure.