We’re excited to introduce Adhoc Verifications, giving you greater control over your identity and fraud screening process!

🔍 What’s new?

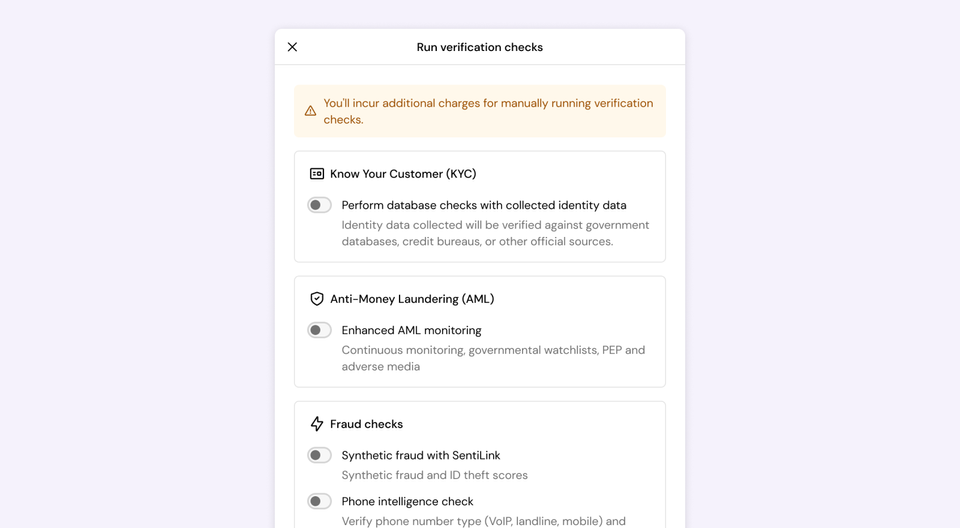

You can now manually run verification checks after a user or business onboarding is complete, including:

- Know Your Customer (KYC) / Know Your Business (KYB): verify identity data against official sources.

- Anti-Money Laundering (AML) monitoring: screen against government watchlists, PEP lists, and adverse media.

- Fraud checks: detect synthetic fraud and assess phone intelligence risks.

💡 How it helps:

- Ensure compliance with KYC/KYB/AML regulations.

- Minimize fraud risk with targeted verifications.

- Be more flexible by running checks when needed.

Try it out today and let us know what you think!